How Incoterms Shape Supply Chain Performance

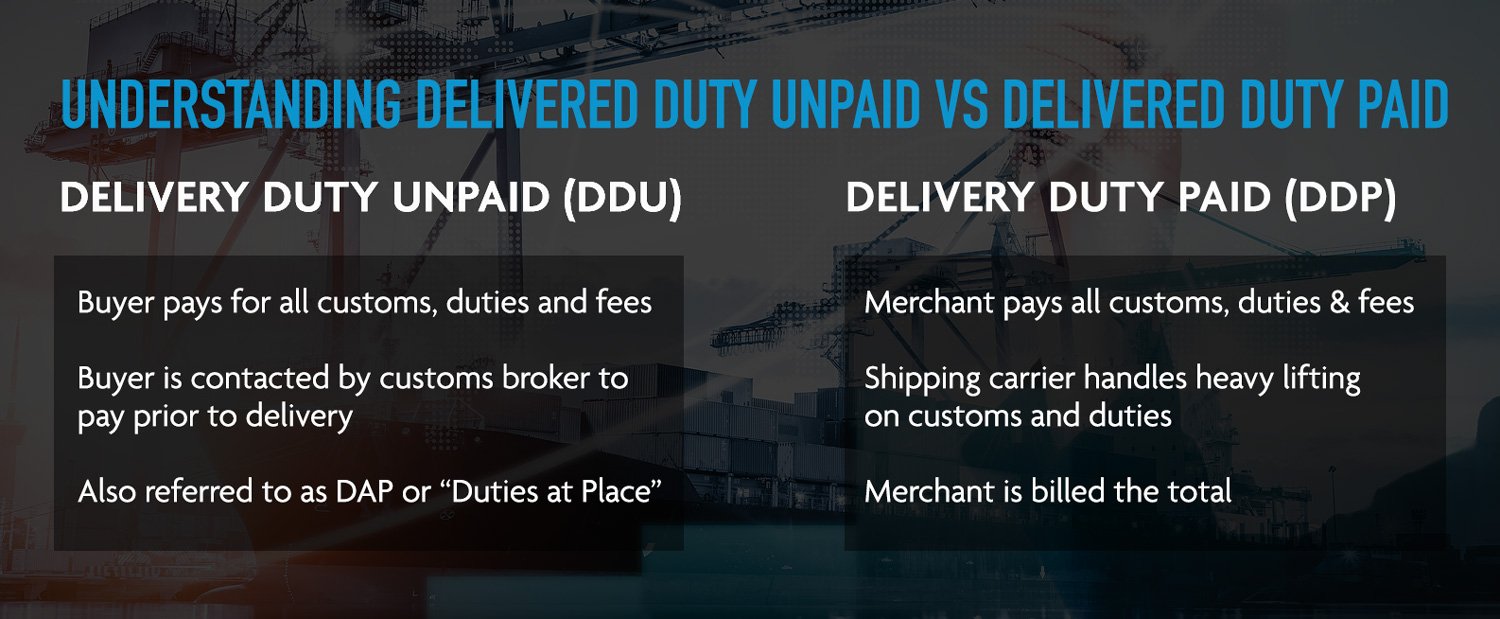

In global manufacturing and industrial sourcing, the cost of a component is only part of the story. How that part moves across borders, who clears customs, and who pays duties can significantly impact lead times, cash flow, and operational efficiency. That is where Incoterms come into play, particularly Delivered Duty Paid (DDP) and Delivered Duty Unpaid (DDU).

While the two terms may sound similar, the responsibilities they assign—and the risks they carry—are very different. Understanding those differences can help procurement teams avoid surprises, protect margins, and choose the right sourcing strategy for their business.

At Mechanical Power (MPI), these decisions are part of daily conversations with OEMs, MROs, and procurement professionals looking to simplify global supply chains while maintaining cost control.

What Delivered Duty Paid Really Means

Delivered Duty Paid places nearly all responsibility on the seller. Under DDP terms, the supplier is accountable for moving goods from origin to the buyer’s named destination, including export documentation, international freight, customs clearance, duties, and applicable taxes. The buyer receives the goods fully landed, without the need to coordinate brokers or manage duty payments.

From a buyer’s perspective, DDP offers predictability. Pricing is clear upfront, landed costs are known, and internal teams are not burdened with customs processes. For companies with lean procurement or logistics teams, this structure can be especially attractive.

However, DDP also requires that the seller be capable of acting as the importer of record in the destination country. Not all overseas suppliers are equipped to handle this responsibility, particularly when regulations, tariffs, or compliance requirements change. When executed poorly, DDP shipments can stall at customs, creating delays that ripple through production schedules.

How DDU Shifts Responsibility

Delivered Duty Unpaid, often replaced in modern Incoterms by Delivered at Place, shifts part of the responsibility back to the buyer. Under DDU, the seller delivers goods to the agreed destination, but the buyer handles import clearance, duties, and taxes.

This approach gives buyers more control over customs brokers, duty management, and compliance strategy. For companies with established logistics partners or in-house import expertise, DDU can reduce costs and offer greater transparency into tariff exposure.

The tradeoff is administrative effort. Buyers must manage customs documentation, monitor duty invoices, and account for variable import costs. For procurement teams focused on total cost reduction rather than convenience, DDU can be a strategic choice. For others, it introduces complexity that distracts from core operations.

Why the Difference Matters in Industrial Sourcing

In industrial supply chains, the impact of Incoterm selection extends beyond freight costs. It influences inventory planning, working capital, and risk allocation. Unexpected duties or clearance delays can halt production lines or erode cost savings achieved during sourcing.

DDP can simplify procurement by bundling logistics into a single price, but that price often includes a premium to cover the seller’s risk. DDU may appear less expensive on paper, yet total landed cost can fluctuate based on tariffs, port congestion, or customs processing times.

The right choice depends on the buyer’s internal capabilities, tolerance for variability, and need for operational certainty. There is no universal answer, only the option that best aligns with business goals.

How Mechanical Power Helps Clients Decide

Mechanical Power works with customers to evaluate shipping terms as part of a broader sourcing strategy. Rather than defaulting to DDP or DDU, Ryadon assesses factors such as component type, country of origin, regulatory requirements, and the customer’s internal logistics resources.

For some programs, DDP provides peace of mind and faster deployment. For others, a DDU structure paired with trusted customs partners delivers long-term cost advantages. In many cases, the optimal solution is a hybrid approach that balances risk, visibility, and control across different product categories.

By coordinating directly with qualified global manufacturers and logistics providers, MPI helps ensure that Incoterms support—not undermine—supply chain performance.

Choosing the Right Path Forward

DDP and DDU are more than shipping acronyms. They are strategic tools that shape how global sourcing programs perform in the real world. The right choice can reduce friction, improve predictability, and protect margins. The wrong one can introduce delays, hidden costs, and operational headaches.

For procurement teams navigating today’s complex trade environment, understanding these terms is essential. Working with a sourcing partner who can translate Incoterms into practical outcomes makes that understanding actionable.

Mechanical Power helps manufacturers move beyond transactional buying toward supply chain strategies built for reliability, transparency, and long-term value.